ESG Use Cases

Straive Data Platform Enables Diverse ESG Use Cases

Our proprietary end-to-end cloud-centric and modular Data Lifecycle Management Platform - Straive Data Platform (SDP). The platform helps to Extract, Transform and Enrich - collecting, curating, and organizing the data into data elements, keywords, indexes, classifications, and deliver into the desired format.

To feed the ESG framework, SDP uses data sources like Annual Reports, CSR documents, 10Ks, news, corporate filings, and more to identify the data points to be extracted. Various text, visual, and public sources are screened and sifted to gather information on ESG indices.

Objective

Tracking ESG data outside of what companies disclose is a cumbersome and challenging task. However, it is a productive activity in several cases. For small and mid-cap companies, ESG disclosure is not mandatory and is rarely reported through company publications.

Moreover, disclosures are reported at low frequency and are generally historical. Voluntary disclosures do not cover all controversies and other adverse ESG events due to reputational risks.

Business Challenges

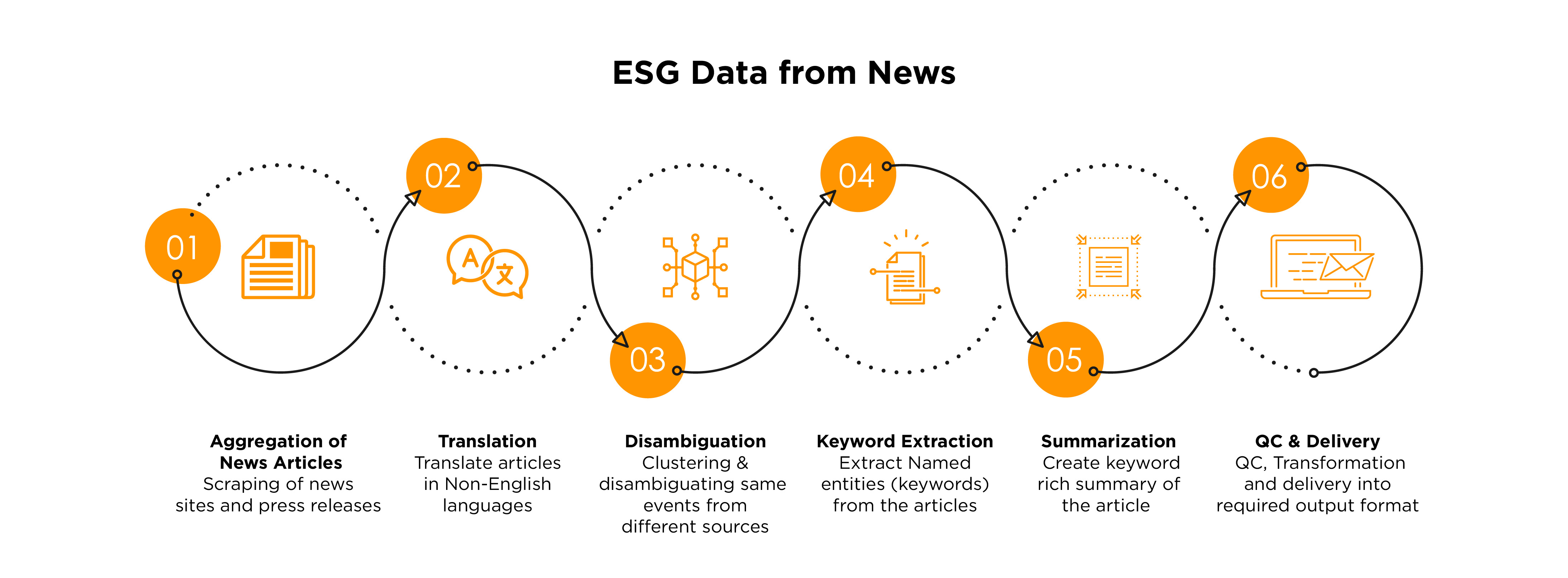

Tracking data from the news requires a very different acquisition model. Some of the significant challenges include:

• Multiple news outlets reporting the same event, which then need to be clustered together to save analyst effort in reviewing

• Multiple false positives delivered by a typical research base or primary keyword search-based approach

•Highly qualitative and undefined data

Straive's ESG Solution

Straive Data platform(SDP) uses a customized taxonomy to solve a client's individual use case.

Key Features and Capabilities

• Customized data exploration UI for individual analyst needs

• ESG Taxonomy defined for every use case

• Can be set up for any publicly available source or internal sources

• Auto-clustering, auto extraction, and auto-filtering engines with a human curation layer

Objective

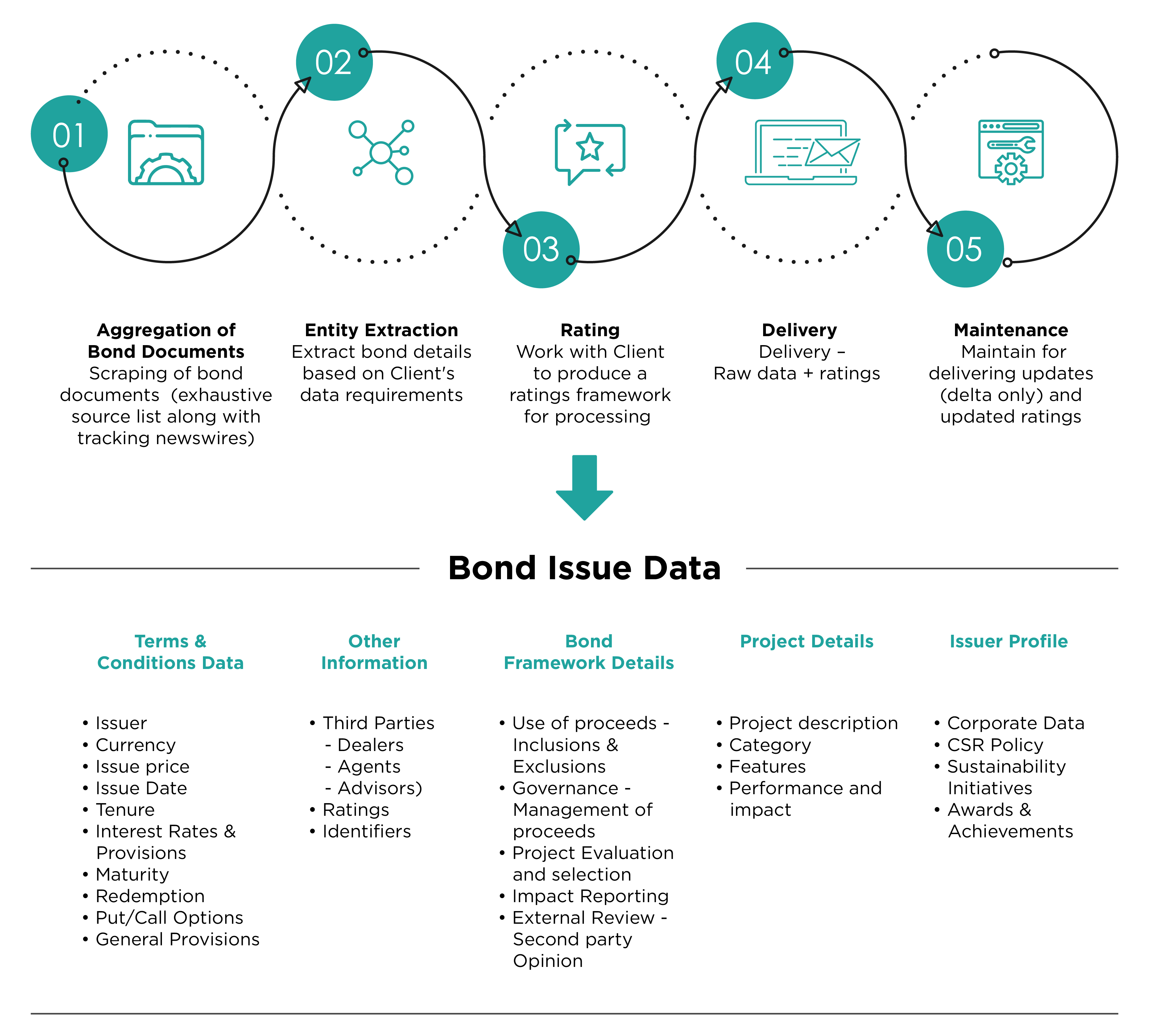

As firms focus on sustainable investing and green/ESG bonds, they seek comprehensive ways to understand issuer ESG metrics and bonds. There is also a specific need to track these bonds as they mature over time.

Business Challenges

• Multiple sources of data with a need to match bond and issuer data

• Limited available existing aggregated sources

• Defining metrics to be tracked based on individual investment strategies

Straive's ESG Solution

Straive Data platform (SDP) tracks over 3000+ green bonds across the world along with relevant issuer metrics.

Key Features and Capabilities

• Customized Data exploration UI for individual analyst needs

• Can be set up for any publicly available source or internal sources

• Weekly tracking for updates on new and existing bonds

• Auto extraction engines with a human curation layer

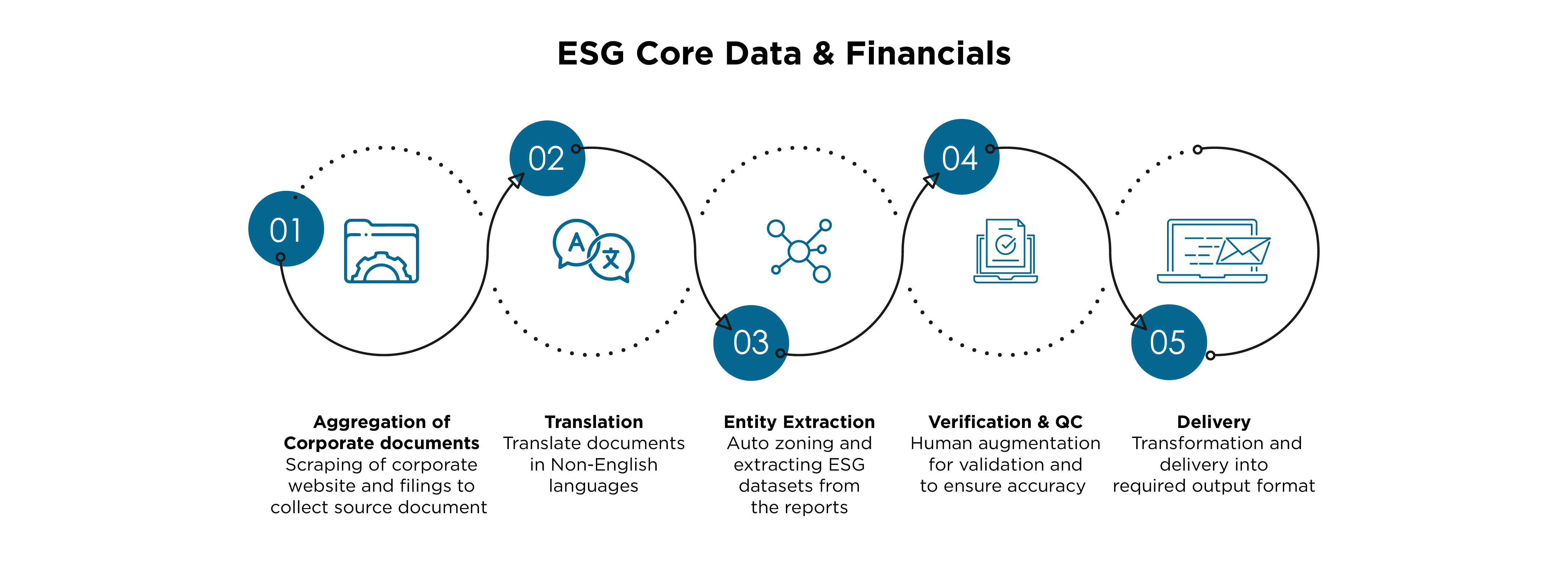

Objective

Extracting ESG data from disclosures is the primary methodology for ESG data strategy today. While quantitative metrics are easy to track and are similar across strategies, qualitative data points vary depending on multiple factors. The data extracted also needs to fit into an ESG framework, including SFDR, SASB, and custom frameworks, depending on the overall ESG and investment strategy. Sometimes this may also take the form of scores, in which case, the metrics must be transformed accordingly.

Business Challenges

Qualitative data points pose a unique challenge. They can produce different results. Variations can occur due to the data owner's definition, the engine's training context, or the engine or analyst extracting the data.

Other challenges companies face while extracting the core ESG data from disclosures include

• Removing analyst's bias

• Timely tracking of multiple sources that are published throughout the year

• Transforming data to meet the enterprise ESG frameworks, which requires a level of nimble customization

Straive's ESG Solution

Straive Data platform (SDP) uses an advanced auto extraction data engine to pull data from Annual Reports, CSR Reports, etc.

Key Features and Capabilities

• Customized Data exploration UI for individual analyst needs

• Use-case specific, custom, rules-based, ML auto extraction engine

• Can be set up for any publicly available source or internal sources

• Automatic update-tracking of sources

-2.png)